Let’s delve into the fascinating world of MicroStrategy and their strategic approach to Bitcoin. 🌟

Introduction

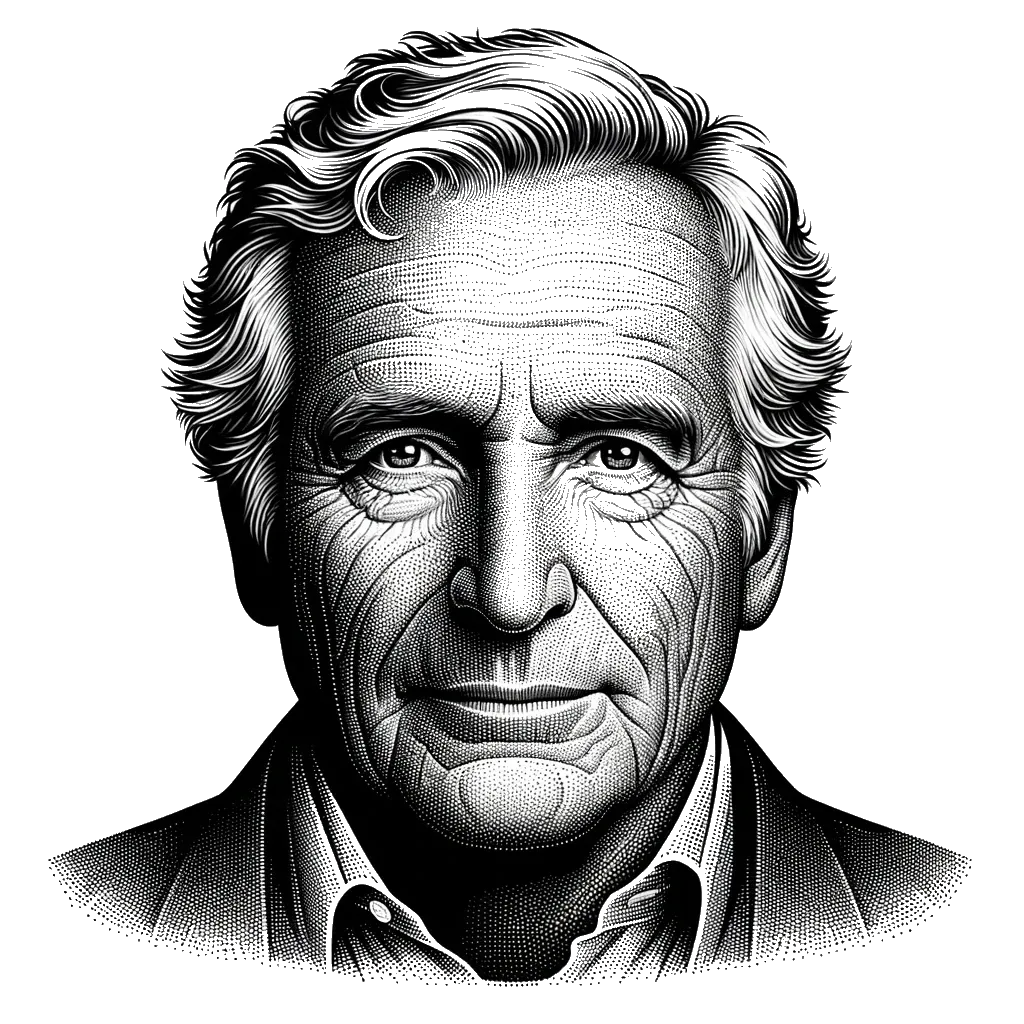

MicroStrategy, a business intelligence and analytics company, has made headlines for its bold move into Bitcoin. Led by its visionary CEO, Michael Saylor, MicroStrategy has developed a playbook that outlines its strategy for integrating Bitcoin into its corporate treasury.

Let's explore the key aspects of MicroStrategy’s Bitcoin playbook and its implications.

1. The Bitcoin Bet

MicroStrategy’s journey began in August 2020 when it announced its first significant Bitcoin purchase. The company invested $250 million of its cash reserves into Bitcoin, signaling its belief in the digital asset’s long-term value. This move was met with both curiosity and skepticism, as it was unprecedented for a publicly traded company to allocate such a substantial amount to a volatile asset.

2. Bitcoin as a Treasury Reserve Asset

MicroStrategy’s playbook emphasizes Bitcoin as a treasury reserve asset. Unlike traditional fiat currencies, Bitcoin is decentralized, limited in supply, and resistant to inflation. By allocating a portion of its treasury to Bitcoin, MicroStrategy aims to protect its capital against currency devaluation and inflation risks. This move aligns with the company’s long-term vision and its commitment to shareholder value.

3. Engineering a Safe Haven

Saylor refers to Bitcoin as the world’s first engineered safe-haven investment. Historically, gold has served as a safe-haven asset, but Bitcoin offers unique advantages. It is portable, divisible, and easily transferable across borders. Additionally, its scarcity and robust security make it an attractive store of value. MicroStrategy’s playbook positions Bitcoin as a hedge against economic uncertainty and a potential inflationary environment.

“They have more to fear by not embracing #Bitcoin than by embracing it.”

— Vivek⚡️ (@Vivek4real_) March 14, 2024

- @saylor pic.twitter.com/w93gws5R9d

4. Educating Other Corporations

MicroStrategy’s CEO has been vocal about his Bitcoin strategy, advocating for other corporations to follow suit. He recommends that companies with substantial cash reserves consider diversifying into Bitcoin. Saylor’s argument centers on the idea that Bitcoin’s volatility has decreased over time, making it a more stable asset. He encourages companies like Apple, Tesla, and Amazon to explore Bitcoin as part of their treasury management.

5. Integration into Financial Statements

MicroStrategy’s playbook extends beyond the balance sheet. The company integrates Bitcoin into its profit and loss (P&L) statements. By accounting for Bitcoin’s fluctuations, MicroStrategy aims to provide transparency to shareholders and regulators. This approach sets a precedent for other companies looking to adopt a similar strategy.

Conclusion

MicroStrategy’s Bitcoin playbook represents a paradigm shift in corporate finance. It challenges conventional norms and demonstrates the growing acceptance of bitcoin in mainstream business. As more companies explore Bitcoin as a treasury asset, the landscape of corporate finance continues to evolve.

In summary, MicroStrategy’s Bitcoin playbook is not just about investing in digital money; it’s about redefining financial resilience and embracing innovation. Whether other corporations will follow suit remains to be seen, but one thing is certain: Bitcoin has found a prominent seat at the corporate table.

Disclaimer: The information here is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any investment decisions.

References: